Introducing Relics: The Solution to Mercenary Liquidity

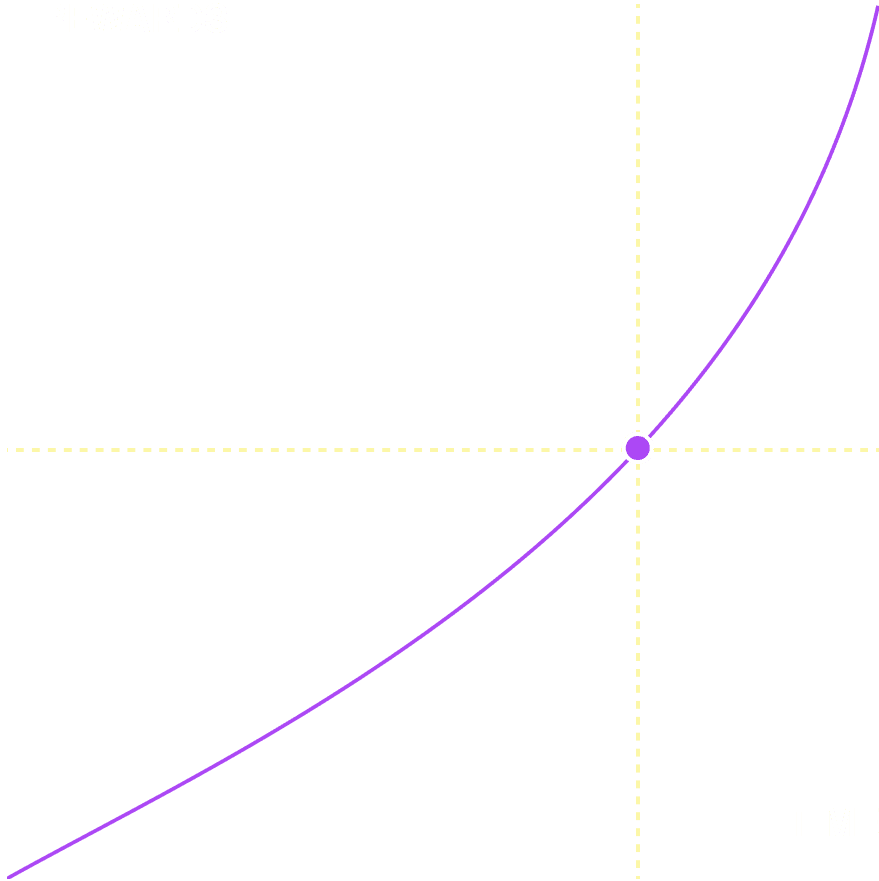

Relics are financial tokens that introduce time-weighted rewards, a mechanism that prevents yield dilution from new participants. The longer you hold a position, the more rewards you receive. Simple and effective.

Rewards That Scale With Time

Most emission systems are frustrating for participants, especially those with long-term commitment. Relics incentivize longer participation and fair reward distribution; ensuring sustainability and fairness for all users, all while preserving the user’s ability to exit the position at any time with no penalty.

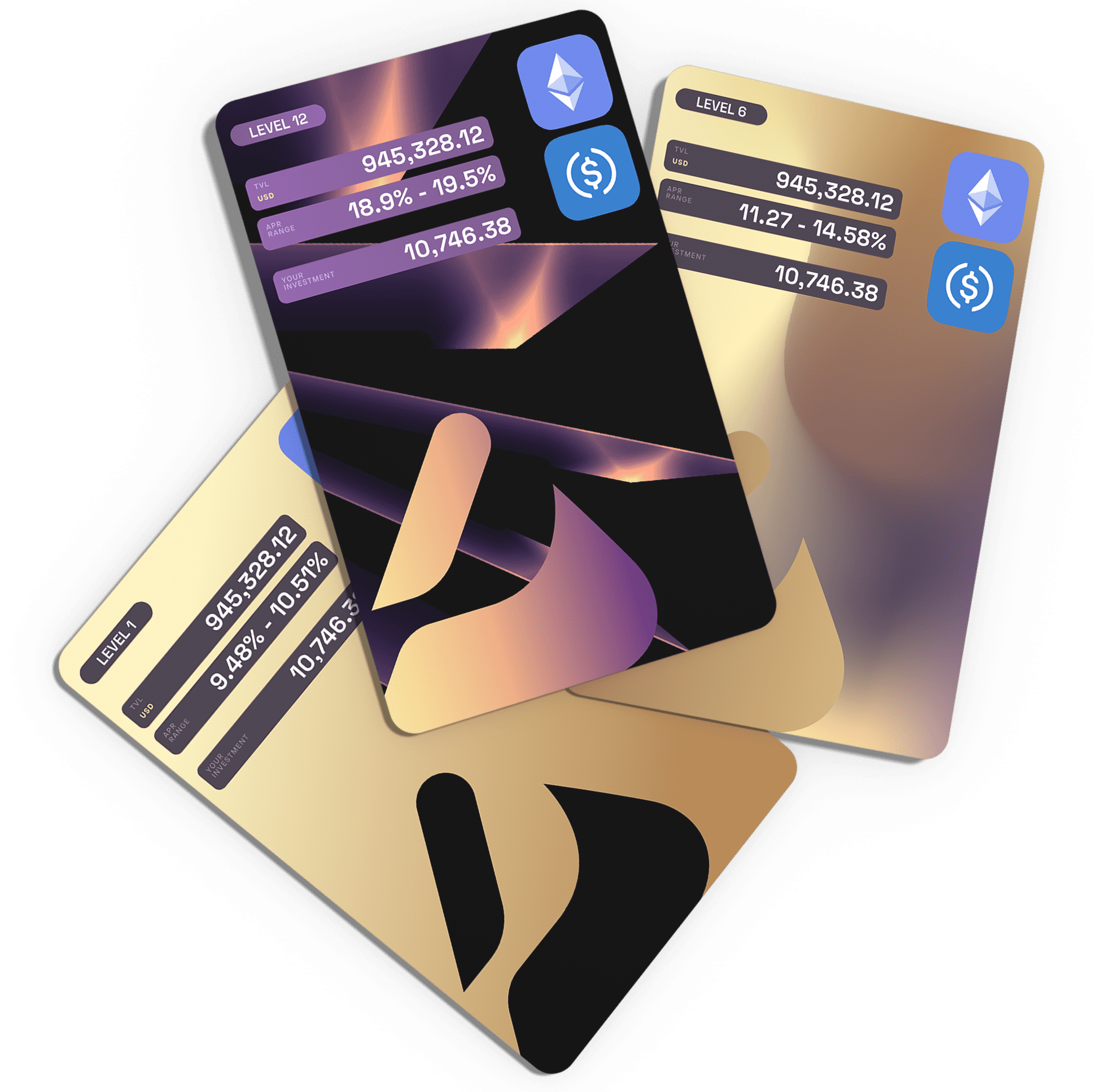

Relics Control Every Block

Financial Non-Fungible Tokens (fNFTs) serve as an effective tool for tracking and transferring complex financial positions between wallets. Digit’s Relics are no exception. By leveraging the latest NFT technology, you can grow, merge, split, and transfer your positions within Digit, and watch how your Relics evolve as your maturity increases.

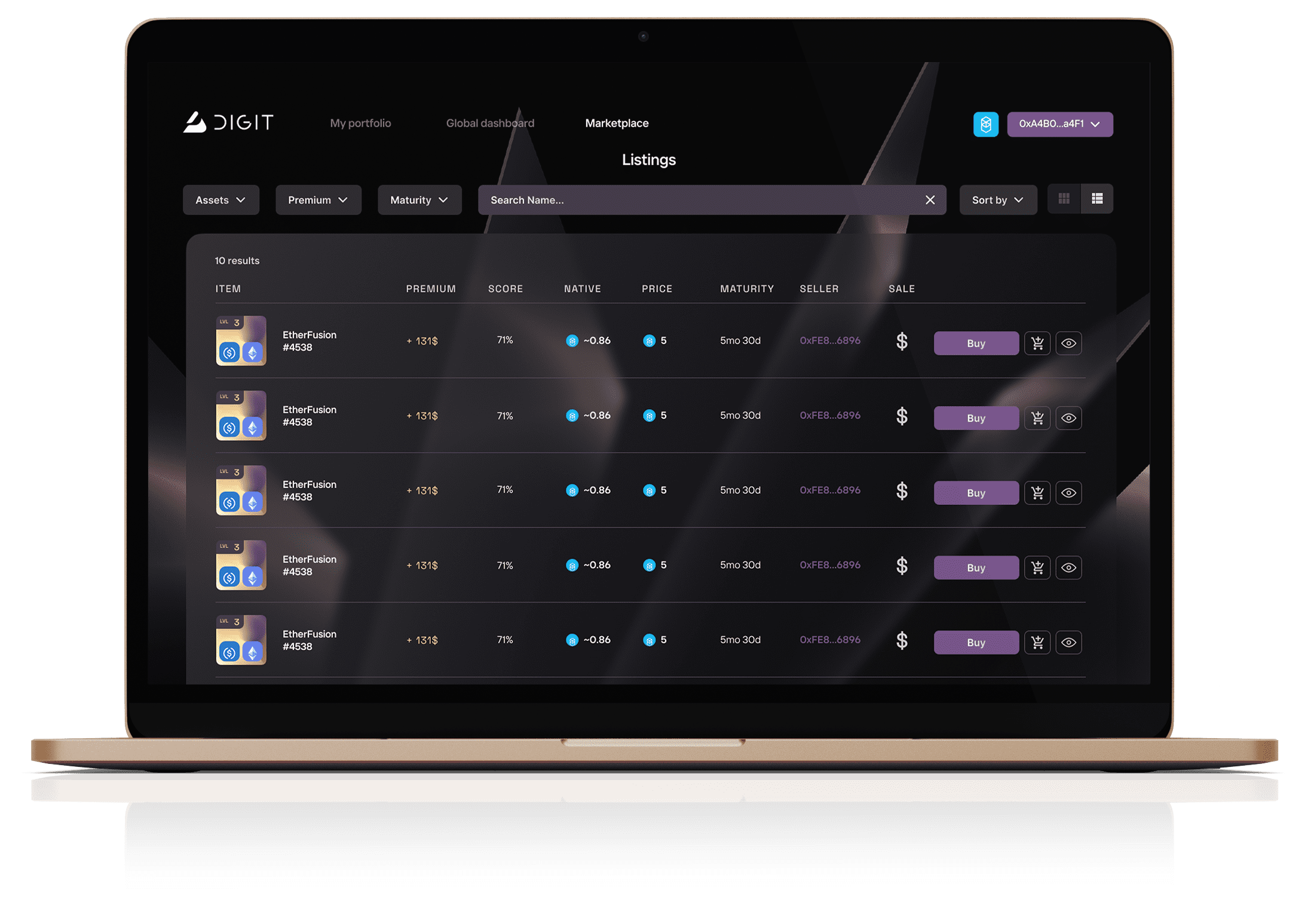

Planned: Sell Lucrative Relics in an Open Marketplace

When you adjust your portfolio, you'll be able to sell the Relic on the market to gain additional value from your long-term holdings. New users can benefit from your position when you're done. Sound exciting? Let us know what you think.

Bringing Adaptable, Flexible, Composable DeFi Advantages

Relics can be made to support practically any DeFi initiative, such as liquidity pools and asset managers (vaults). They are fully composable and redeemable for their underlying assets at any time, and they can be built atop virtually any position to enable maturity-adjusted rewards across any maturity curve desired.

Users Can Enjoy a Range of Multi-Reward Functionality

Relics support an extensive array of various rewards, allowing other ecosystems to leverage Digit’s flexibility and maximize their incentives to promote positive liquidity behavior.